In this first part of a three-part series, we discuss three templates of large software systems with examples - Google Search, Ethereum, and UPI. We suggest that Digital Public Goods (DPGs) like UPI have been influenced by online services such as Google Search but haven’t yet been influenced by ideas on distributed ledger technologies (DLTs). We then compare the contrasting evolution of DLTs and DPGs and make the case for a distributed ledger as part of the DPG stack.

1. Scale

“Everything that can be found in the universe on a large scale is reflected in a human being on a small scale.” — Franz Bardon

A remarkable feature of software systems is the possibility of scaling them to gargantuan proportions without commensurate increase in complexity.

What enables such scaling? Three different templates of scaling have emerged in the last two decades.

The most popular and also most profitable ones are software systems designed by enterprises to deliver digital products and services. Consider Google Search which today indexes over 13 trillion webpages and is used about 5.6 billion times a day. These are unprecedented numbers in the usage of engineered systems. This scale is primarily enabled by two phenomena. One, with access to ubiquitous compute, such as through smartphones, over 5 billion people worldwide have a demand for such internet services. And two, companies (such as Google) have created business models which do not charge users for the services (such as web search) but instead commoditize access to users through two-sided markets (such as online advertising). The moat around such business models is further strengthened by Artificial Intelligence (AI) which accrues increasing competitive advantage with data collected from large systems.

Another more recent way to build large software systems are public distributed ledgers. In their most popular form, these ledgers provide the infrastructure for cryptocurrencies such as Bitcoin, Ethereum, and many others. Just on Ethereum, there are over 200 million account balances which are kept in sync through a distributed protocol with no centralized regulation. Again, this is an unprecedented number of users, who don’t necessarily trust each other, but transact with high stakes (market-cap of Ethereum is almost 200 billion USD). Unlike in systems such as Google Search which are based on aggregating demand to a central service, scale in a distributed ledger is based on algorithmic robustness of the underlying consensus protocol. This decentralized structure, which by necessity needs to be interoperable, has led to rapid innovation in the space of decentralized finance (DeFi) and more broadly decentralized applications (dApps).

A third template to build large software systems is the emergence of population-scale digital public goods. One such example is the Unified Payments Interface (UPI) in India, which is a real-time payment system both for peer-to-peer and person-to-merchant transactions run by a unit of the central bank. In the previous financial year, UPI enabled 46 billion transactions amounting to about Rs 15 trillion. These numbers are even more remarkable given that UPI was launched just 6 years ago. While systems such as Google Search scale because of innovative business models, systems such as Ethereum scale because algorithmic robustness enables trustless transactions, a system like UPI scales because of an efficient and interoperable system that is backed by a government-based root-of-trust. Such systems are often non-exclusionary and thus enable commercial and state participants to support and benefit from the digital public good. And they truly generate public good - the Indian government digitally transferred money to over 900 million citizens just last year, cutting off intermediaries.

2. Trifecta

Human behaviour flows from three sources: desire, emotion, and knowledge. — Plato

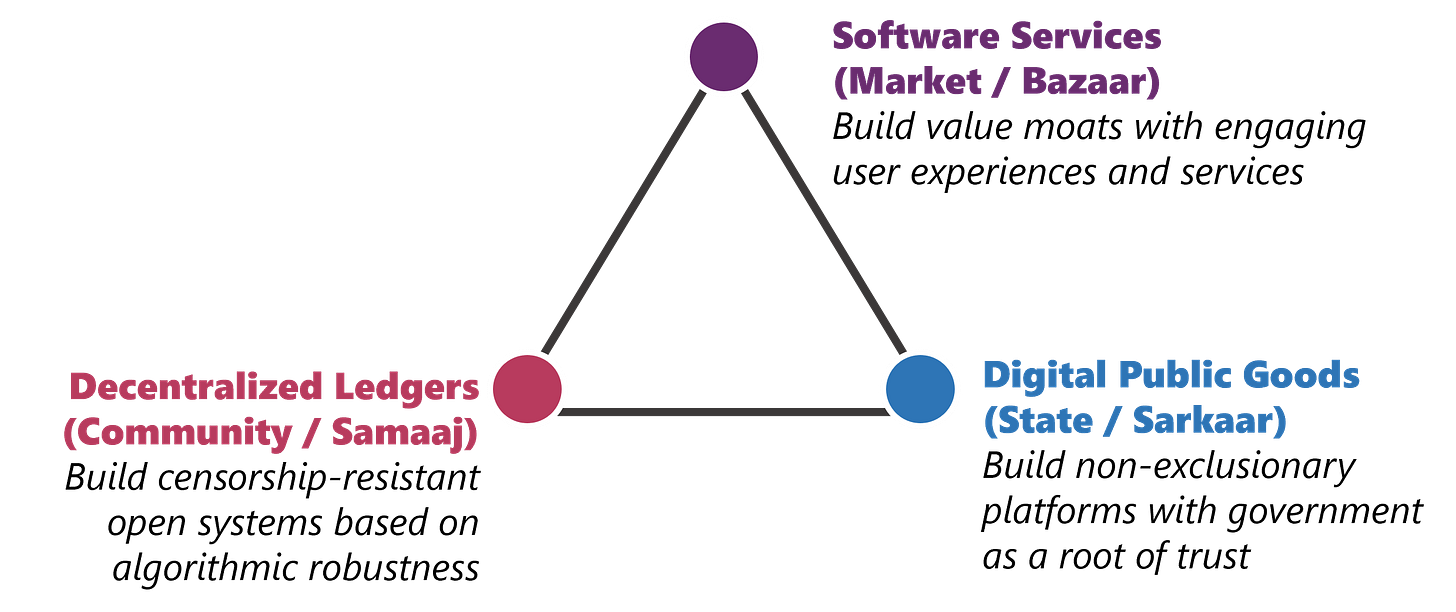

It is tempting to look at the above three templates at scaling software systems and map them on to the trifecta of market/industry (bazaar), citizens (samaaj), and state (sarkaar).

A system like Google Search is built by industry with a profit motive. A profit motive is necessary to create innovative solutions to the very hard problem of aggregating user demand. A system like Ethereum is built and sustained by citizens to enable trustless transactions. Beyond the hyper-financialized fog surrounding distributed ledgers today, there is genuine hope that distributed ledgers enable the creation of co-determined societies. A system like UPI is built and governed by the state. Indeed, it is the state’s regulatory prowess and the citizens’ implicit trust in the state (of a well-functioning democracy) that enables systems like UPI to scale and provide value at population-scale.

All these three represent unique values. The right to profit drives systems like Google search. The right to sovereign ownership drives systems like Ethereum. While the right to regulate drives systems like UPI. And all three have their rightful places in the quest to build ever larger systems of increasing efficiency.

And all three of them have their respective pitfalls too. Systems like Google Search court the risk of violating user privacy and worse of harvesting user attention for profit. Systems like Ethereum can degenerate into centralized power structures (such as is the case with many crypto exchanges). And systems like UPI will have to defend against any attempts by the state and other partners to pry into citizens’ data.

3. Contrasts

There is no quality in this world that is not what it is merely by contrast. Nothing exists in itself. — Herman Melville

Given the vastly different incentives and agencies involved with the three templates, there is ample opportunity of exchanges in best practices between them. In this series, we are most concerned with what digital public goods (DPGs) like UPI can imbibe from the other two templates.

The design of DPGs has been championed by public minded software engineers and leaders who have had the chance to study the growth of systems like Google Search. Hence, the design of DPGs takes much inspiration from the first template. For instance, DPGs like India’s identity system Aadhaar run out of containerized cloud services which brings necessary efficiencies of scale that make systems like Google Search possible. DPGs also adopt innovations such as AI: Aadhaar uses biometric authentication at the population level to match fingerprints, iris scans, and recently even faces. Indeed, a major contribution of DPG pioneers was to get public sector units to think like a Google when building systems like Aadhaar and UPI.

While DPG creators have borrowed from systems such as Google Search, we believe there has not been adequate attention on learnings from the world of distributed ledgers. There are various reasons for this. First, the space of distributed ledgers may still be considered to be in the beta stage, with rapid changes (such as the impending Ethereum merge) and many security vulnerabilities (such as the stable-coin Terra losing its peg and several instances of hacking of private wallets). Second, given that cryptocurrencies enable non-state actors to transact financially, there is deep apprehension within state and related actors about cryptocurrencies and by extension about distributed ledger technologies. Third, the heady rise of the cryptocurrencies has provided little room for the developers in this space to think of second-order effects such as public good deeply enough.

We thus hypothesize that there is a fundamental value to be unlocked in designing the next generation of DPGs with ideas that are emerging from the world of distributed ledgers. To explore this value, we begin first by looking at the evolution of distributed ledger technologies (DLT) and digital public goods (DPGs).

~

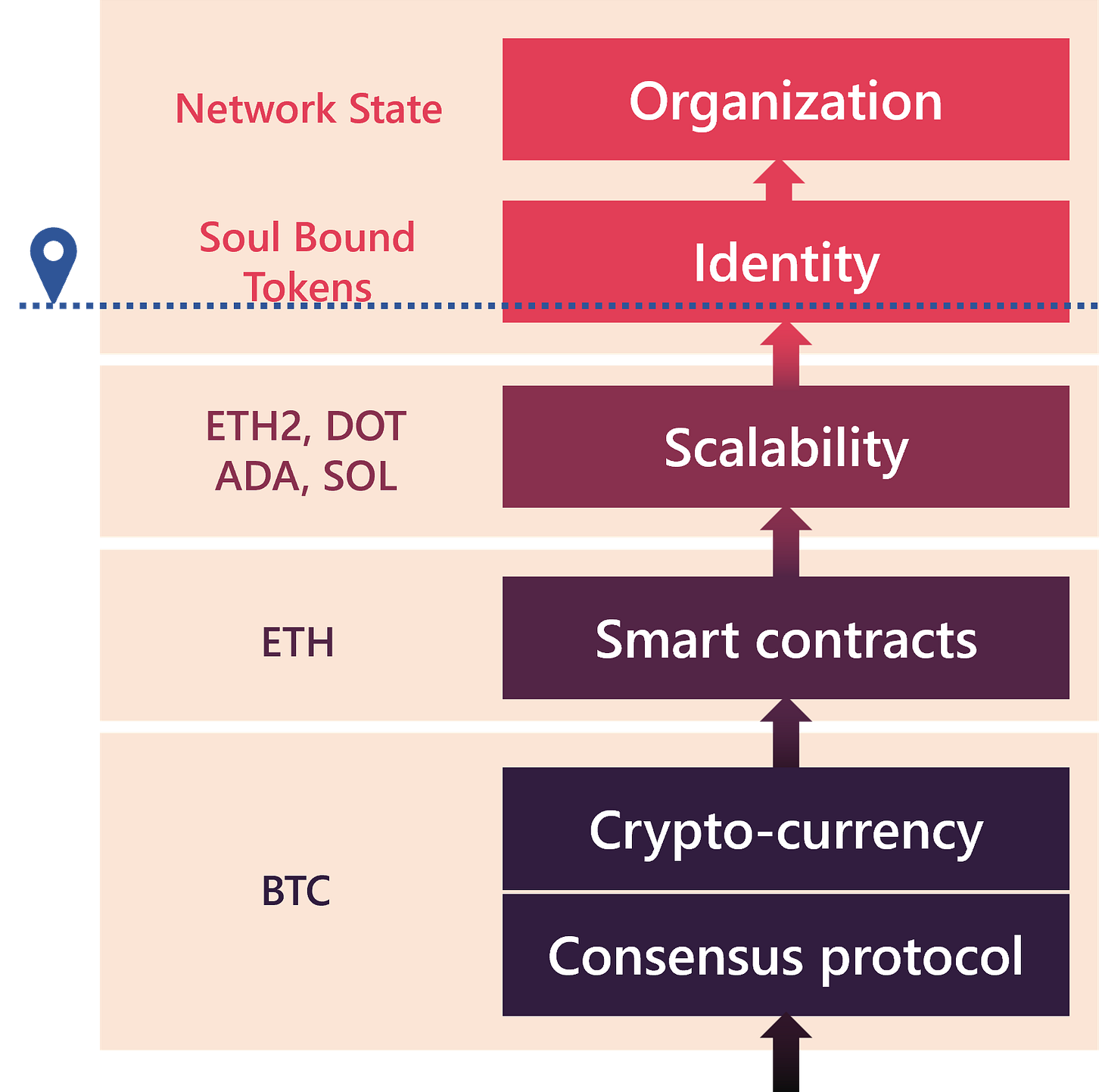

The first generation of crypto-currencies began with Bitcoin which simultaneously proposed two things - a distributed consensus protocol and a cryptocurrency which provided incentives for actors to support the consensus mechanism. This duo of a protocol and incentive was a remarkable contribution, perhaps worthy of a Nobel Prize in Economics if only we knew who was behind it. This enabled anyone to create an anonymous account, purchase and transact Bitcoins, whose accounts are maintained in the public ledger. The next iteration was the introduction of programmability through smart contracts as proposed in Ethereum. The fundamental shift here was to move from keeping accounts, like in Bitcoin, to distributed computing through an abstraction of a ‘world’s computer’. Combining payments and contracts has opened up a vast space of possibilities with decentralized finance. The next iteration, which is still ongoing, is to address the challenge of high costs of Bitcoin and Ethereum in processing transactions. Several solutions, with alternative consensus protocols and cryptocurrencies have been proposed to make ledger transactions efficient and thus scalable. Potential solutions such as proof-of-stake, para-chains, zero-knowledge proofs, and many others are being actively tried, tested, and adopted. This is where things are today in the DLT world.

What is next for DLTs? There is clearly more to be done in improving the base algorithms for scalability, creating robust governance structures of the committees leading these efforts, and in plugging security vulnerabilities. Also, there is far more clarity required in the public space about the nature, legality, and effects of these technologies. Beyond these, a philosophical directionality for DLTs is to move towards creating identity and eventually organizations. In contrast to current practice of anonymous participation, there is a genuine case for having identity on-chain to allow for encoding social relationships of trust, which intermediate most of our day-to-day transactions. The hope is that identity can create a self-reinforcing cycle between trusted individuals creating societies of common interest and these societies providing further trust to participating individuals. Such societies may scale to entire ‘network states’ creating possibility of positive interactions between individuals separated by distances of varying range but aligned on principles. While this is theory today, bordering even on philosophy, we are optimistic that they will be realized in the coming decade, ushering in new agency for citizens to collaborate.

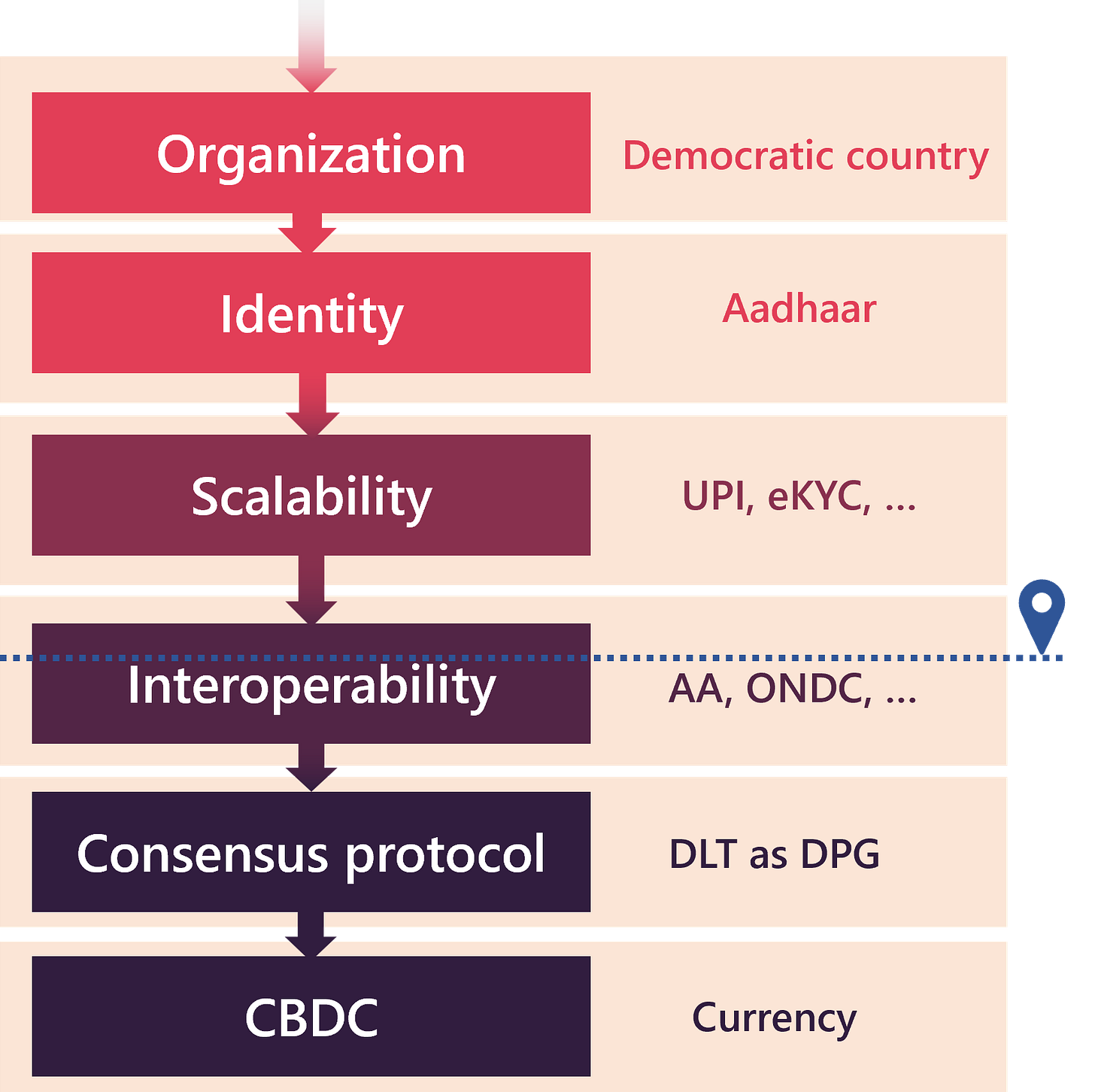

Now let us discuss the trajectory of DPGs. As discussed, DPGs such as UPI in India, emerged within the context of a democratic nation where the government has both the mandate and the ability to execute on behalf of citizens. It is hard to over-emphasize this fact that DPGs are rooted in the trust that citizens have on elected governments and their officials. So, in a way, DPGs start exactly where DLTs are headed. And the contrast continues. The first large-scale DPG in India was the Aadhaar system which provides a unique digital identity to all citizens, the largest such effort in the world. For many citizens, Aadhaar was the very first public document they received from the government legalizing their very citizenship. Today over 1.3 billion Aadhaar cards have been issued in the country and an astonishing 99.9% of adult holders use it every month - an enviable metric. So, the very DPG in India was around identity. And this then enabled other DPGs to come on top. Transactions through banks were cumbersome and and those through credit cards were expensive. UPI was designed to make payments far more efficient and thus increase the scale of digital payments. Similarly, onboarding users to various accounts (such as a bank account or a demat account) was slow and required physical presence of a validator with the customer to obtain a KYC (know-your-customer) authorization. With Aadhaar and mobile OTP based eKYC, this process was made fully digital and scaled nationally. Today, Aadhaar based KYC is performed about 10 million times daily. Thus, DPGs such as UPI and eKYC enabled scaling of processes required to onboard customers and digitally transact.

While identity, payments, and online user onboarding may not strike as innovative, their efficient and reliable roll-out at population scale has brought much value. But the next of DPGs, under current development, may prove to be truly innovative contributions. The first is the idea of an Account Aggregator (AA) which allows for users to provide consented access to their data to third parties. For instance, I may provide a creditor access to my tax returns and bank statement during the processing of a loan application. Today, over a billion user accounts are compatible with the AA framework and this has the potential to transform small-business lending in India, where small creditors can with confidence lend money to people who have proven financial records intermediated by privacy-preserving account aggregators. While finance could be the first use-case, given the earnest support of the central bank, the concept of AA can apply broadly to any user data locked with service providers such as banks, hospitals, universities, companies, etc. to third parties. Broadly, AA enables interoperability of systems consented by users. This puts significantly more power in the hands of users than licenses such as GDPR. Another innovative DPG, under construction, is the Open Network for Digital Commerce (ONDC), which provides a set of protocols for interoperable exchange between shoppers, e-commerce providers, and retailers. The potential for ONDC is to explore efficiencies by unbundling the supply of products, the platform for purchase, the logistics of delivery, and digital payment reconciliation. Both AA and ONDC are first-of-a-kind efforts to create interoperability between a wide range of providers and consumers.

This is where DPGs today are. In the abstract, most DPGs today are creating interoperable standards for transactions, i.e., data, while the next set of DPGs may also focus on specialized computation. This includes development of AI models as public goods (such as the Bhashini project) and also private computation through confidential clean rooms.

The two trajectories taken by DLTs and DPGs show a sharp contrast - they have both started from two different ends, algorithmic robustness and state regulation, and are aiming to build scalable systems to enable individuals, societies, and business to interact. This sharp contrast suggests that DPGs can consider both distributed ledgers and currency (of course centrally backed) as potential directions forward.

~

What would a distributed ledger offer as a digital public good? How should we reimagine the distributed ledger in an ecosystem of existing DPGs, such as Aadhaar, UPI, account aggregators, confidential clean rooms, and ONDC? How would we reimagine the consensus protocol with non-fungible identities? How can the root-of-trust with the government be leveraged? What current use-cases can become more efficient and what new use-cases can emerge with the distributed ledger? What are the principles in the design of such a distributed ledger? We will discuss our take on these questions in the second part of this series.

Have there been any good usecases of these technologies in India?? more curious about the use of the blockchain technology